Blog

Republican presidential candidates and the tragedy of the commons

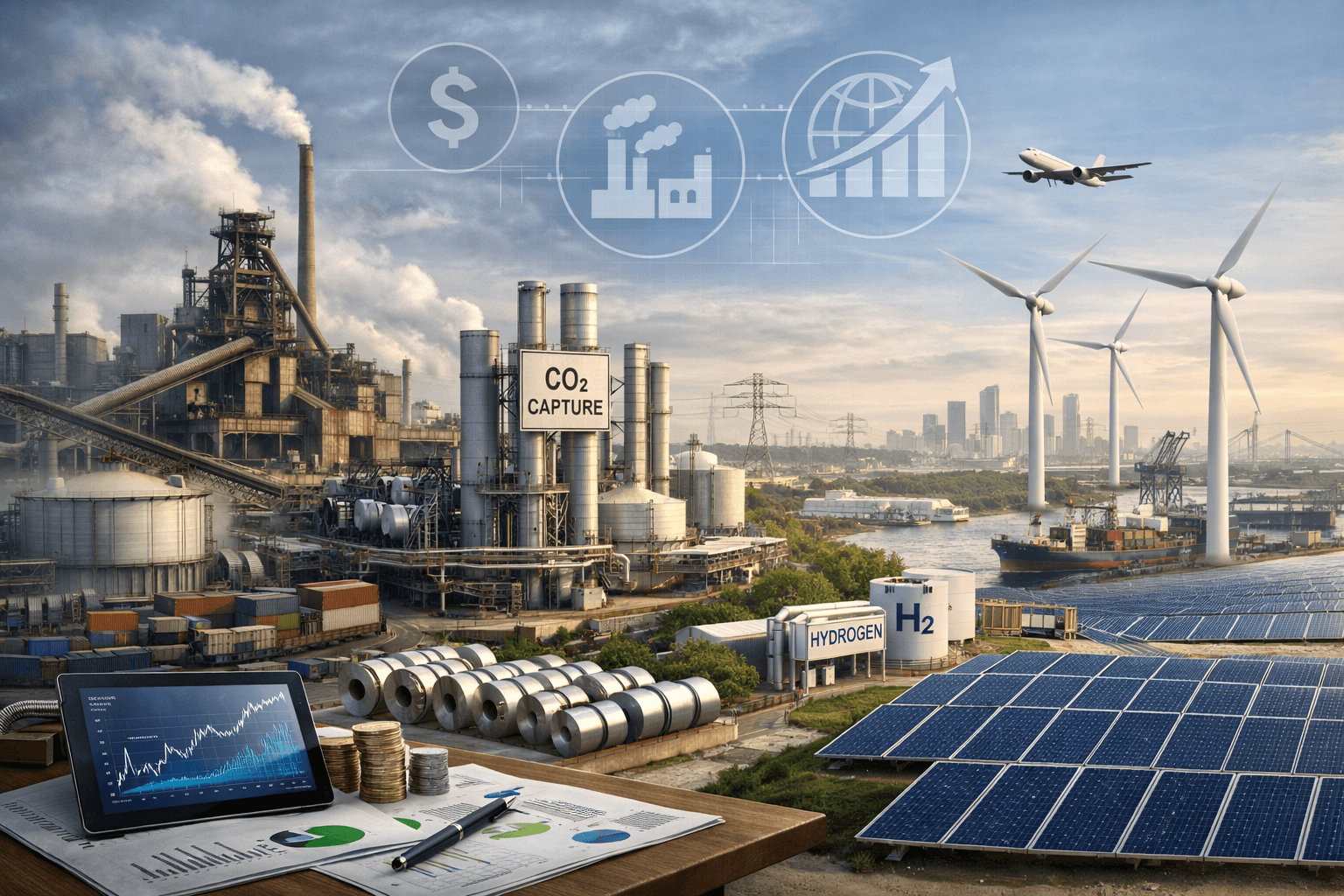

In a world that is becoming more vulnerable to extreme weather events, outdated assumptions about asset values need to be adjusted.

Fred van Beuningen

Aug 29, 2023

"The climate change agenda is a hoax," said Presidential Republican candidate Vivek Ramaswamy at last week's debate. "These green subsidies that Biden has put in, all he's done is help China because he doesn't understand," said former South Carolina Gov. Nikki Haley, adding, "Half of the batteries for electric vehicles are made in China, so that's not helping the environment, you're putting money in China's pocket."

One of the first questions asked by the moderator was if the candidates believed human behavior was causing climate change. She asked the candidates to raise their hands if they accepted the science. "We're not school children, let's have the debate," said Gov. DeSantis.

Mr. DeSantis is right: schoolchildren are taught higher-order thinking skills like critical thinking, problem-solving, and scientific paradigms to research, understand, and interpret the natural and social world. Politicians seeking high public office should use those skills to understand how systemic problems can be solved and what needs to be done to leave a better world for future generations.

Tragedy of the Commons

Climate change is an existential threat to the future potential of human existence, as meticulously explained by scientist Toby Ord, and it is tempting to write about the facts and science of climate. Still, this summer, all we had to do was to look outside at a world burning. On the day of the debate, the temperature spiked to at least 100 degrees in Milwaukee, Wis., where the debate was held — a rare benchmark for the northern city.

Republican presidential candidates do not have to travel to Oxford, where Mr. Ord is teaching, to access top-notch climate science. They can talk to MIT or the governmental institute NASA. This presumes, however, the sense of responsibility to rely upon facts, science, and morality to implement the necessary changes.

As for Gov. Haley's China argument that the increasing demand for EVs makes China richer, China is indeed the dominant player in global mineral processing. One can argue that trade wars and increased political tensions are not very strategic. Geographic diversification of critical minerals supply chains, coupled with globally aligned statutory due diligence requirements to make these supply chains cleaner and effective international collaboration, would be a more strategic response than blaming the Chinese for taking a long view.

The Tragedy of the Commons metaphor illustrates the argument that free access and unrestricted demand for a finite resource like (prehistoric) solar, earth materials, and clean water ultimately reduce the resource through over-exploitation. This occurs because the benefits of exploitation accrue to individuals or groups, each of whom is motivated to maximize the use of the resource to the point in which they become reliant on it, while the costs of the exploitation are borne by all those to whom the resource is available. These costs (externalities) affect those who did not choose to incur that cost; a feature of the "tragedy of the commons". Politicians who ignore this "tragedy" and the adverse effects associated with it put short-term personal gains like position or power before the potential of future generations.

Undervaluing climate risks in our economy: Reassessment required

Apart from strategic and moral considerations, there is the economy. In a world that is becoming more vulnerable to extreme weather events, outdated assumptions about asset values need to be adjusted. Lex in depth (Financial Times, August 17th ) headlined: "How investors are under-pricing climate risks" and talks about a "climate Minsky moment" (sudden corrections in asset values). Equities have not priced in climate risks. The perceived "remoteness" in times of risk may be one explanation (next to the wicked problem of presidential candidates being in denial), lack of reliable data, and another. The data group Cambridge Econometrics and Ortec Finance recently crunched numbers for Singapore's GIC, an investor with a long horizon. In a "net zero" scenario involving ambitious decarbonization, cumulative returns over 40 years were 10 percent lower than a baseline that assumed no climate change. The most pessimistic outcome was a "failed transition" that put the world on course for a rise of more than 4C from pre-industrial levels by 2100. Cumulative returns were then nearly 40 percent lower than the baseline, though some feel the outcome could be much worse than that, given the unknowable levels of disruption that such a rise might trigger.

The US housing market could be an impacted sector where climate risks like flooding are not priced in yet. Lex concludes that time is running out for decarbonizing the economy and that financial institutions have begun to price in climate risks but that they should also start to think about the cost of inaction.

Challenges of achieving carbon-neutral targets

Many global companies have set carbon-neutral targets, and in an earlier blog, I argued that these targets are easy to set but harder to achieve. It was already discouraging to see that the stock prices barely moved when carbon neutrality was announced. Missing these targets, carbon neutrality in 2050 means carbon negative in 2035 for some industries, which may bring a climate Minsky moment closer with higher investor awareness of the physical climate risks.

Carbon-neutral targets of hard-to-abate sectors can be value-creating but require the design and execution of clear strategies involving portfolio shifts, decarbonization of legacy assets, and the introduction of new technologies.