Blog

Working Towards Net-Zero: Investments In The Circular Economy

May 18, 2023

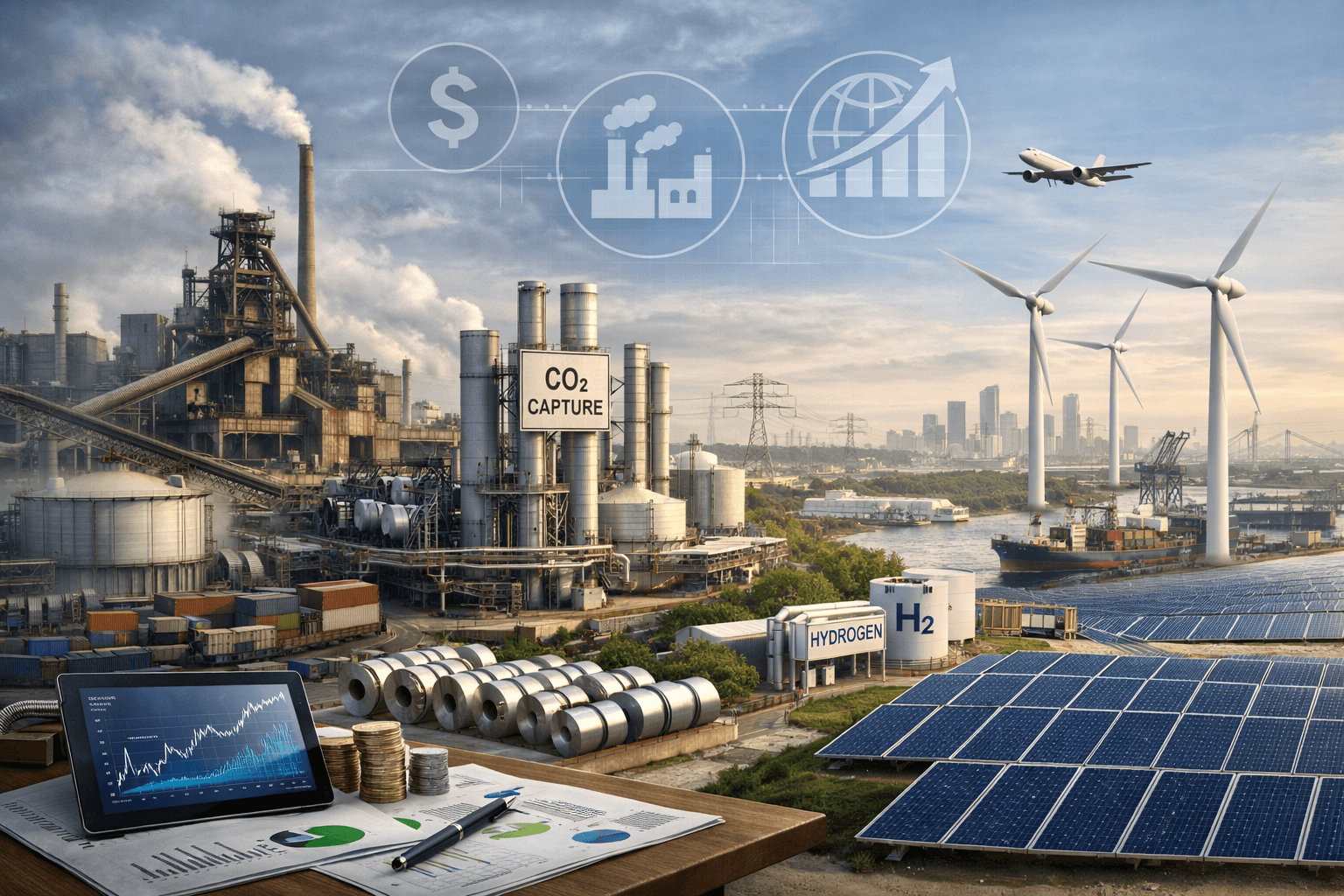

Achieving carbon neutral targets and a net-zero emission means focussing beyond just the energy transition. The production, use, and eventual disposal of industrial materials such as steel, plastics, aluminium, and cement accounts for about 25% of all global CO2 emissions. What’s needed is a focus on lower-impact ways to produce, use, and dispose of these materials.

The application of circular economy principles of eliminating waste and pollution, circulating resources, and regenerating nature, can help this transition towards low-impact industrial materials.

This means designing buildings, automobiles, and electronics, to be used longer, reused many times, remanufactured, and, in the end, recycled. This keeps the resources that went into making them – the materials (and energy) – in the economy.

McKinsey estimates the emissions reduction potential of the circular economy for Europe is 56% for a 2050 baseline. The EU critical raw materials act has set a 15% recycling target.

Circular economy drivers

It is easy to see why circularity is seen as strategic by resource-intensive companies: it controls costs, reduces resource dependence, and creates new business opportunities. Reducing environmental footprint and operational waste, and also using critical resources efficiently is appealing to executives.

Policymakers are increasingly aware too of the unprecedented amounts of waste that our planet is not capable of metabolizing.

But creating a circular business model is challenging—and taking the wrong approach can be expensive.

Innovation

To create value in a circular economy, we need to harness innovation to grow regenerative businesses. Technological innovation can help companies towards smarter product design and strategic resource management.

The Ellen MacArthur Foundation has laid the conceptual groundwork: cycling small, cycling for longer, cascaded uses, and regenerative cycles. Consultants and business strategists have followed. Atasu, Dumas, and van Wassenhove published “The circular business model” (Harvard business review July-August 2021) and identified the three basic strategies to achieve circularity: retain product ownership, product life extension, and design for recycling.

Success or failure with circularity will continue to depend on our commitment towards sustainability, backed by investments in it.

Circular economy and venture capital

When identifying venture investment opportunities in the circular economy, Chrysalix focuses on materials for which strong circularity market drivers like scarcity, sustainability, availability, and cost exist. We analyse the constraints; the bottlenecks impeding the system to reach high performance in terms of its purpose (Goldratt, 1990).

Once we have understood the constraints, we then ask what “needs to become true” and if technology can unlock the opportunity, using frameworks with material-specific evaluation criteria.

The rest is VC 101. Is there enough cost-to-value difference? Can we source the technology from our global research and start-up network? Is the capital intensity acceptable and the supply chain risks manageable? Do we see a path to a high-performance leadership team and a growth trajectory to a sizeable company?

Our Portfolio

We have uncovered and added two new venture opportunities in our portfolio. We are working with the founders and teams of Sortera Alloys (for a breakthrough technology for non-ferrous scrap metal recycling) and C2CA (end-of-life concrete recycling).

Chrysalix continues to look for other investment opportunities in circular economy and waste-to-value, combining sustainability with financial value.