Blog

Put Your Capital Where It Counts

Fred van Beuningen

Mar 17, 2021

Co-authored by Gail Whiteman, founder of Arctic Basecamp and Professor of Sustainability at the University of Exeter Business School

Previously published on Renewable Energy World

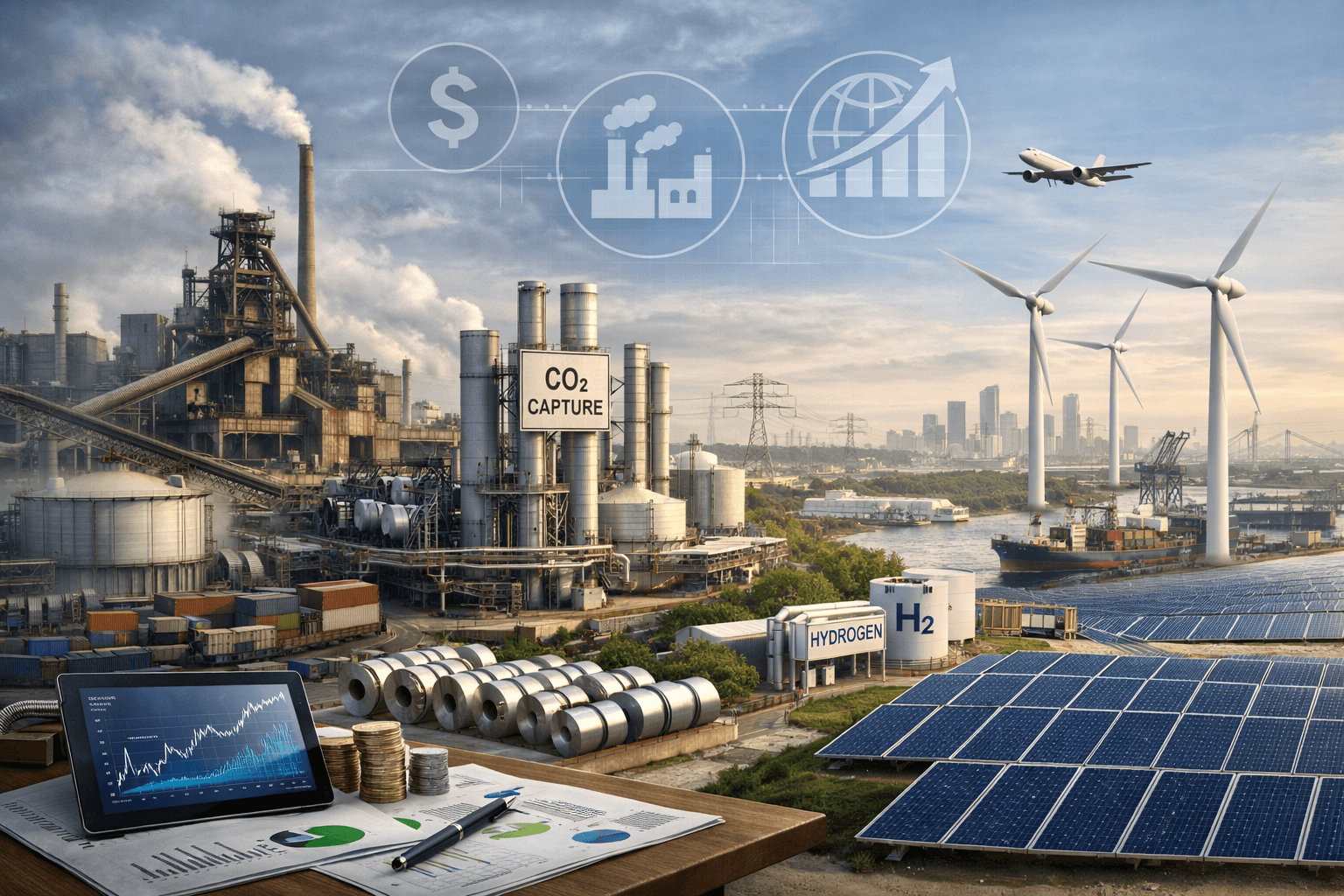

Every major economy has an industrial zone like the Port of Rotterdam, a place where smokestacks, pipes, and tanks tell one story of climate change. Anything that can be made of crude oil is made at the Port. It is a complicated place. On the one hand, it provides jobs and the necessities of modern life. On the other, it propels us towards ecological disaster.

Depending on your perspective, the Port may cause you to feel despair and helplessness. Or, it may fill you with a sense of hope and opportunity.

That difference brought us together, as a climate scientist and an investor, to discuss how industrial zones around the world could, within a few years, tell a drastically different story about our climate. Much will depend on where financiers put their capital.

Like Gail, you may wonder how we can possibly limit warming to +1.5° C when places reminiscent of Mordor continuously pump carbon into the atmosphere. Having presented the global risks from Arctic climate change to audiences at the World Economic Forum at Davos each year, Gail is worried. All the scientific data show the Arctic is in crisis, and this will affect lives throughout the world.

In fact, the Arctic is warming at two times the global average. In 2020, the Arctic as a whole had its warmest year on record since data collection began in 1979. Record temperatures were reached in Siberia over the summer (+100° Fahrenheit / 38° C), resulting in wildfires that, in turn, released a never-before-seen amount of emissions.

Fred, who for 23 years has commuted along the Botlek terminal highway with its sweeping views of the Port, sees something different. An industrialist turned venture investor, Fred knows that the Port is becoming one of the world’s most sustainable industrial clusters. Good-faith efforts to reuse carbon, heat and steam are underway with a target to reduce the Port’s emissions to 50% of 1990 levels by 2025.

Where Gail sees despair, Fred sees opportunity. The EU’s climate commitments mean that we will replace those smokestacks with clean technologies, sooner or later. Scientists say we must. Governments say we should. The innovators say we can. Investors say…well…not much, with some exceptions.

Thus, our message to financial institutions is as follows: now is the time to act with your dollars, euros, francs, pesos, pounds, riyals, rupees, yen, yuan, and won. Now is the time to put your capital where it counts.

What does that mean?

The value of ESG assets surpassed $40.5 trillion in 2020. That’s outstanding. However, too many ESG funds merely invest in low-carbon tech companies from Silicon Valley, not in the startups developing essential climate technologies. They invest in less bad instead of different and better.

We want to direct your attention—and resources—to companies that can make a difference. Those that can restore natural carbon sinks through soil sequestration, ecosystem recovery, and regenerative agriculture. Those that can create artificial sinks with technological carbon capture, utilization, and storage. And those that can transform the Port of Rotterdam into the clean, circular cluster of the future.

This economic transformation is coming, and it will affect your balance sheets. Countries, cities and regions representing over 50 percent of world GDP have net-zero targets in place, as do more than 1,500 companies with combined revenues of $12.5 trillion USD.

Solar and wind energy, electric vehicles, and plant-based meats are outcompeting their subsidized, carbon-intensive predecessors. Exxon Mobil, the most valuable U.S. company a mere seven years ago, is out of the Dow Jones Industrial Average. Tesla, a pioneer in electric vehicles and battery technology, is now part of the S&P 500.

Mitigating climate change will require more than just updated stock indices. We advocate for the approach outlined in “A System Change Compass”, co-authored by Systemiq and The Club of Rome. It aligns scientific research, policymaking, business ecosystems, venture capital and international cooperation towards a post-COVID economic revitalization strategy that can hold climate change to no more than +1.5° C of warming. For that outcome to occur, worldwide emissions must reach net-zero by 2050 at latest.

The roadmap may be complex, but the financial math isn’t. Moody’s Analytics predicts that +2°C of warming would cost the global economy $69 trillion USD by 2100, not including the incalculable losses borne by communities that face rising sea levels, crop failure, devastating heatwaves and displacement from their homes. The cost of inaction is too high.

We want financiers to commit $1 trillion USD annually to decarbonization and negative emissions technologies. That is likely enough capital to mitigate emissions from seven sectors: cement, chemicals, electric power, mining, steel, transport, and oil and gas. These account for about 40% of global emissions but remain integral to modern standards of living.

With access to a portfolio of decarbonization technologies, the Port of Rotterdam could look radically different in 10 years. North Sea wind installations could produce enough clean electricity and hydrogen to replace the coal-fired smokestacks. The Port’s circular economy could recycle waste carbon into the biochemical feedstocks and clean products of the future.

Imagine if industrial complexes on six continents followed the Port’s lead. The returns to investors would be immense. More importantly, though, these investments could help to regenerate the world economy, creating an abundance of new jobs. The Arctic sea ice, a driver of climate stability and biodiversity on this planet, might be preserved for future generations.

We joined together, one climate scientist and one investor, to share our sense of despair and hope. Scientists have a responsibility to share the truth, no matter how difficult it is to hear. In return, financiers have a fiduciary and moral responsibility to invest in the future as it will be.

So put your capital where it counts. Those smokestacks, pipes and tanks won’t replace themselves.