Blog

Carbon Neutral Targets; Easy To Set, Harder To Achieve

Fred van Beuningen

Jan 19, 2023

In the past five years, two related trends have emerged in response to the growing recognition that climate change leads to financial impacts. First, a growing number of investors are taking more serious account of climate change in their investment allocation. Over 450 financial firms that collectively represent $130 trillion in assets have committed to “net zero” transition outcomes in their investments. Second, global companies are responding to this growing investor pressure by making net zero commitments. Eighty-four of the world’s largest companies have set climate change commitments, the majority of which were made or updated as of January 2020. However, only 27 mention climate change in investor presentations on long-term strategic planning. Of these, only eight featured climate change as a central component in strategy communications to investors. Seventy-nine companies reference climate change in their annual reports. However, only 25 disclosed plans to take advantage of climate business opportunities and only 13 provided details on planned capital allocation in support of this.

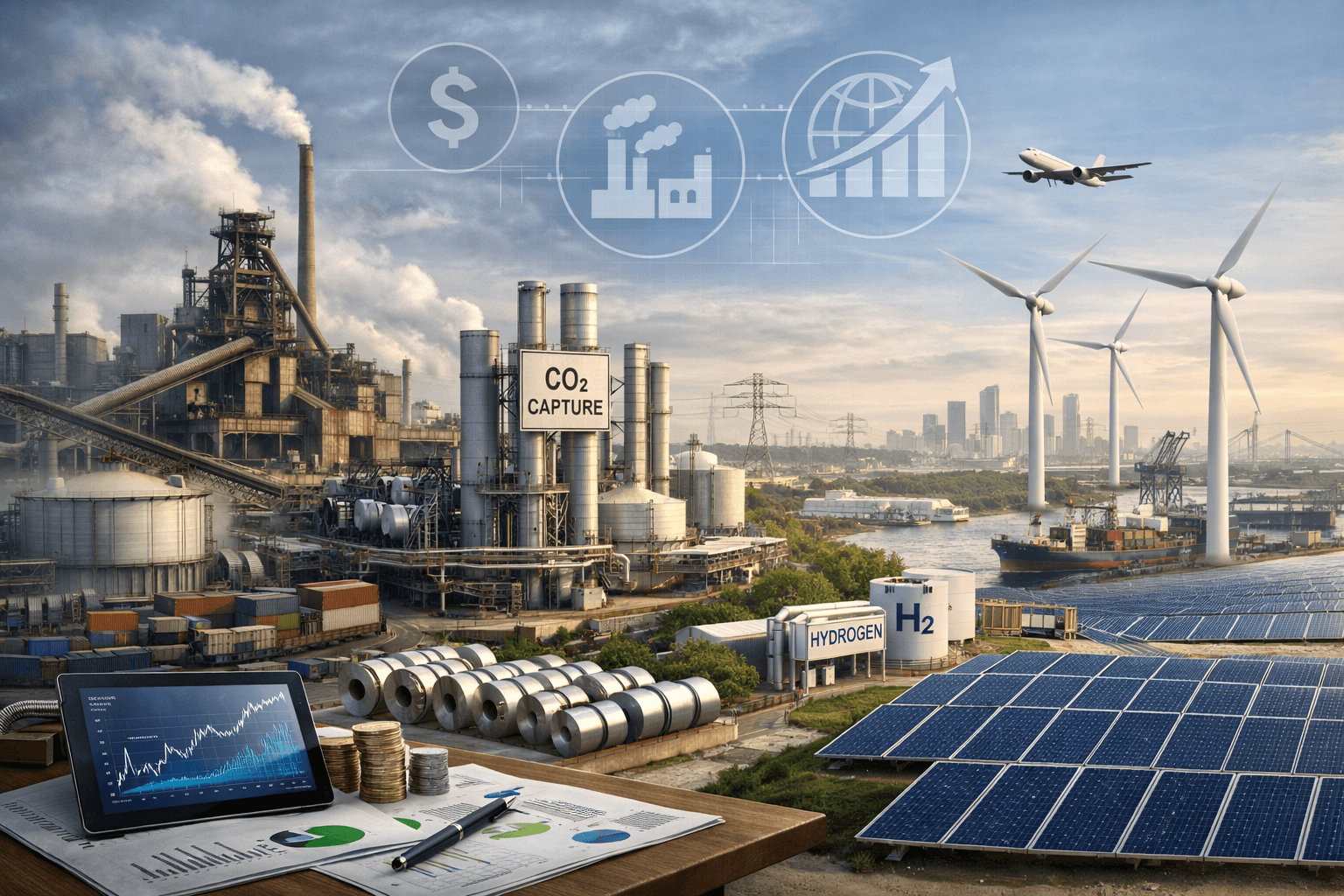

To become carbon neutral by 2050, as many of these companies aim for, they have to be carbon negative by 2030. This will require much more than strategic intent and action; portfolio management, new technologies, and decarbonization of existing assets (in hard-to-abate sectors, legacy assets will continue to emit and those emissions need to be compensated for).

One explanation of this “implementation gap” could be the lack of stock price reaction, positive or negative, following the net zero announcements; another could be that decarbonization is essentially seen as a cost to the business, pushing prices up and putting market share at risk.

Talk is cheap, capital expenditure (CapEx) consistency is much harder. What could help is to shift the narrative from decarbonization as a cost to carbon neutrality as a value creation opportunity. If a company is not immediately vulnerable to a carbon price and has capital available to invest, it can transform its portfolio and focus on high growth segments, build new green businesses and lead in decarbonizing the existing supply chains, and as a consequence create value for society and shareholders alike. Such business transformation requires vision, an understanding of how existing capabilities can be leveraged for the carbon economy, and leadership that can articulate and communicate the longer-term value creation opportunity.

The carbon neutral journey will create sources of sustainable competitive advantage, will have costs and benefits, and sets a higher bar for the industry as a whole.

Decarbonization roadmaps for the hard-to-abate industries, where carbon is simultaneously used as a feedstock and a source of energy, are available, and it is often claimed that the technologies needed to decarbonize these industries are already available. The reality is a little more complex, not only because of the systemic nature of the energy and materials transitions, but also because many of these technologies are no simple drop ins, they are in early adoption like green hydrogen, or not yet commercially available like carbon utilization. These hard-to-abate sectors like chemicals, mining and cement support life as we know it. The realistic option is to decouple their emissions from their growth.

We identified the following key decarbonization technology levers for the hard-to-abate industries:

Energy efficiency and process improvement

Fuel and feedstock switch

Materials efficiency and substitution

Circularity, waste to value

Carbon capture, storage and utilization

Nature based and engineered negative emissions technologies, and

The analytics, marketing and sales of carbon credits and enabling digital technologies

Many things need “to become true” for these technologies to aggressively scale and have real climate impact. Venture capital must play a role by developing an attractive investment thesis for these technologies, source the best options, and reduce the risk profile so that the technologies can be integrated into industrial supply chains.

For all the good ESG intentions of the financial sector, where the rubber hits the road is where companies articulate how carbon neutral fits into their vision for sustainable competitive advantage and future growth, and that will have to include innovation and technology at the beginning of the risk curve. When capital is put in responsible and experienced hands, climate and financial value will go hand in hand.

Chrysalix has a history of venture investing in climate technology, we were early investors in carbon capture, fusion technology, and more recently in metals and concrete circularity. Our new fund will exclusively focus on supporting carbon neutral strategies of resource intensive industries.