Blog

After COVID-19, The Oil Industry Will Not Return To “Normal”

Wal van Lierop

Apr 7, 2020

As published on Forbes.com

The coronavirus pandemic has shuttered the world’s economies, overwhelmed healthcare systems and taken loved ones from us. Politicians have promised their citizens a “return to normal” following the pandemic. However understandable, this longing for “normal” will lead us to a mirage. Worse, our recovery from COVID-19 could be a short-lived victory if we aspire only to have a “normal” economy again.

Normal created a climate change timebomb that may make the economic consequences of coronavirus look mild by comparison. Normal would give two brutal dictators the power to topple North America’s fossil fuel industry whenever they feel like it.

Normal also caused the mass destruction of ecosystems, human desperation for animal protein and increased human-wildlife contact. Combined, these factors led Ebola, Hanta, bird flu, SARS, MERS and now COVID-19 to find a new, more plentiful host in human beings.

Stimulus spending around the world has already eclipsed the 2009 recovery measures and “New Deal” programs of the 1930s. And more spending is inevitable. Will your taxpayer money be wasted on a return to normal? Or, could it be used to create a new roaring 20s and an economy that thrives for decades to come?

The Oil End Game

Normal is no longer desirable or secure in the fossil fuel industry. In late February 2020, as stock markets tumbled and Asian oil demand evaporated, Russia and OPEC were still coordinating production levels under an agreement known as OPEC+. It was formed, ostensibly, to counter the American shale oil boom, which had turned the U.S. into the world largest producer.

In early March, at a meeting in OPEC’s headquarters in Vienna, Saudi Arabia proposed that OPEC+ slice production by 1 million barrels, with Russia shouldering half the cut. Russia refused, so Saudi Arabia retaliated by starting a price war.

A month later, Saudi Crown Prince Mohammed bin Salman (aka, MBS) and Russian President Vladimir Putin still seem unwilling to back down. Thanks to their spat and the pandemic recession, WTI crude is trading around $25 per barrel, which is at least $15 below the breakeven price for the typical North American oil well. The situation is even worse in the Canadian oil sands where, as The Financial Post put it, Canadian heavy oil is now “cheaper than a pint of beer.” Most U.S. and Canadian producers will not be able to survive—which is part of why Putin is in no rush to negotiate with MBS.

Saudi Arabia and Russia seem to be initiating the “Oil End Game.” Even before the pandemic, Michael Liebreich, energy consultant and founder of Bloomberg New Energy Finance, predicted that petroleum demand would peak and fall before 2030. The transition from fossil fuels to clean energy is bound to kill demand for petroleum, the lifeblood of these two countries. Saudi Arabia and Russia need to be among the last countries to pump oil out of the ground.

Autocrats on Autopilot

Yet, Saudi Arabia and Russia cannot sustain $25 oil for long without consequences either. The Kingdom requires about $83 USD oil to balance its budget, while Russia’s breakeven price is around $42.

MBS’s long-term strategy, Saudi 2030 Vision, plans to diversify the economy off oil funded by—you guessed it—oil. Saudi Arabia needs a new economy in place before the energy transition happens. Without strong oil revenues, though, Saudi Arabia cannot pull off Vision 2030, nor can it continue to generously subsidize its citizens.

Two-thirds of the Saudi population works for the government. Half the population is under 25 years old, and youth unemployment fluctuates between 25% and 30%. A protracted price war could spur social unrest and a backlash against the royal family, which is known for its lavish spending.

Nor is Putin in a position to sustain the price war. If he wants to be ruler for life, as he has made clear, then he needs to reverse declining living standards in Russia. That will require massive increases in public spending that Russia cannot afford if oil prices stay too low for too long.

Meanwhile, eager to create some positive economic news, President Trump tweeted on April 2nd that he had brokered a deal between Putin and MBS, which sent oil prices soaring. North American oil CEOs expressed relief. But so far, Russia hasn’t reached its limit in the price war yet, and the OPEC+ meeting scheduled for Monday, April 6 to discuss a possible deal has been cancelled.

Don’t be surprised to see an agreement on supply cuts soon, but don’t be fooled. The demand for petroleum is projected to fall 20% in April. Hence, any kind of agreement may be a cheap play by MBS and Putin to please their friend Trump, while knowing that storage facilities are reaching capacity. As long as demand doesn’t pick up unexpectedly, their oil has nowhere to go. The moment that changes they will start pumping again, and more oil players in the U.S. and Canada will face financially unattractive consolidation or even bankruptcy.

There is no return to normal for the shale and oil sands producers. From now on, the fate of the oil industry is tied to the whims of two egomaniacal autocrats. Demand will continue to decrease as low-cost renewables keep pushing the energy transition.

Not a Time to Celebrate

There are certainly mixed emotions in the cleantech community. Of course we want to see the energy transition succeed and the oil industry fade. But no one in their right mind wants that transition to happen at the expense of vulnerable communities.

As of 2018, Canada’s oil, gas and coal sectors sector directly employed over 269,000 people and indirectly supports 550,000 jobs. In the United States, those three sectors employ at least 1.6 million people. The energy transition will create new, higher-paying jobs. But right now, the green economy cannot create new jobs faster than the oil industry is shedding old ones.

Thus, Canada and the United States are in a bind. There is a temptation to bail out oil, if only to keep people employed and ensure that these overleveraged companies don’t drag banks underwater.

Financial support for oil workers is an imperative, but support for the oil sector is a waste of money, whether the Saudis and Russians stay their course or not. Investments in shale and the Canadian oil sands are bound to become stranded assets, even if we return to “normal.” Oil’s days were numbered before coronavirus, and they will be numbered after it.

A Future Better than Normal

It makes no sense to revive a dying oil industry only to kill it again a few years later. It makes no sense to recreate jobs that will not survive the energy transition. Fossil fuels are in decline despite already enjoying billions in government subsidies. Saudi Arabia and Russia will retain the power to drive North American producers out of business whenever it suits them. There is no scenario where fossil fuels make a full and sustained recovery from this crisis.

In the near term, North American politicians must prioritize food, shelter and safety for out-of-work citizens. Longer term, though, if politicians are going to inject trillions of taxpayer dollars into reviving the North American economy, here’s a thought: allocate taxpayer money to companies that are creating the future, not doing CPR on the past.

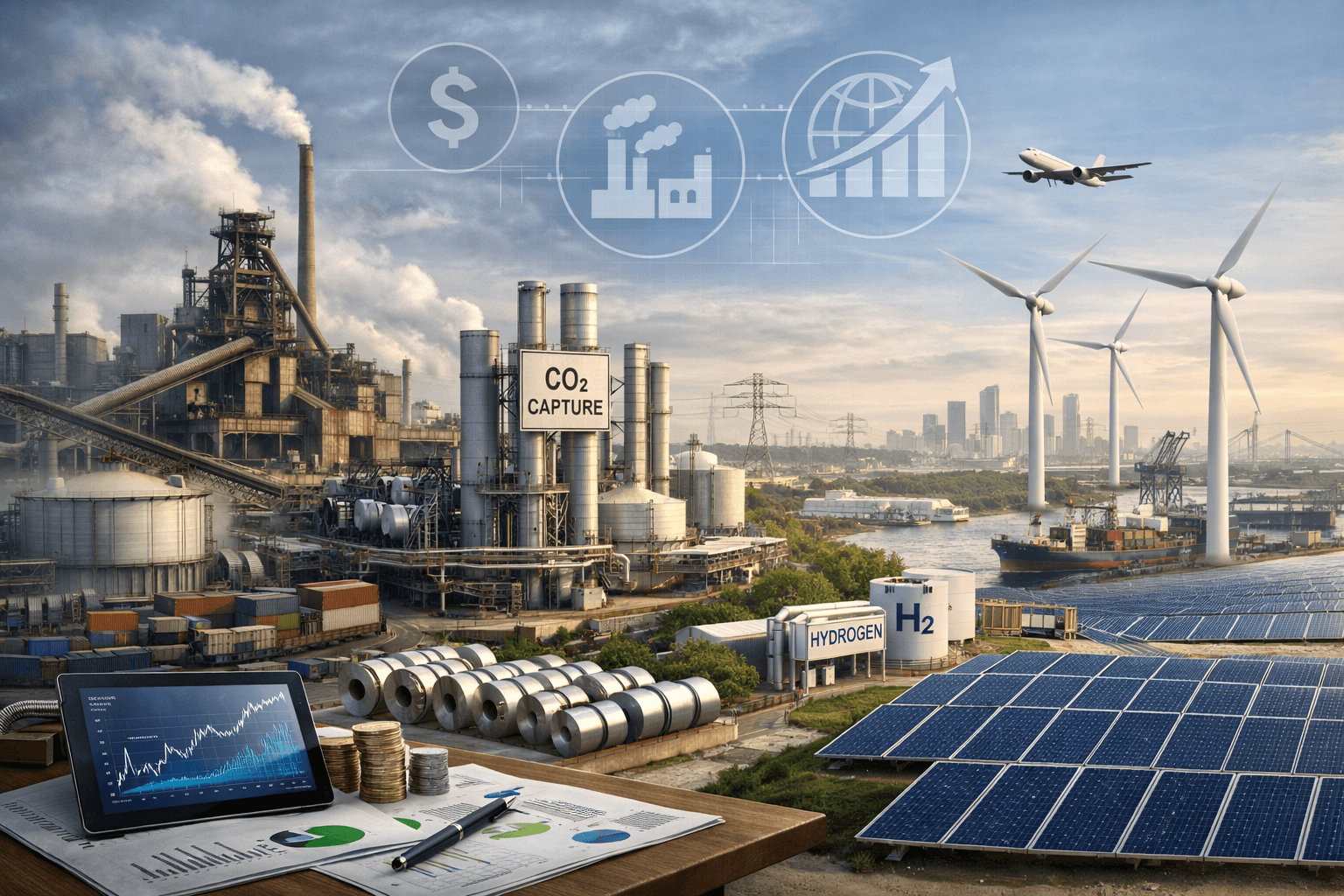

Now is the time to invest in nuclear fusion, the holy grail of energy. Now is the time to expand global energy storage and electric vehicle infrastructure. Now is the time to invest in carbon capture, storage and utilization (CCSU). Now is the time to build high-voltage power lines that can bring clean energy from regions of abundance to areas of scarcity. Now is the time to repurpose fossil fuels for advanced new materials and food solutions. And now is the time to ramp up green hydrogen.

Let’s not misuse taxpayer money to rebuild an economy that survives COVID-19 and then succumbs to climate change. Instead, let’s create a future economy with good jobs, a habitable earth and reprieve from the whims of erratic dictators. There is no path back to normal. And we can do much, much better than normal if we refuse to waste this crisis.