Blog

Accusations Of ESG Greenwashing Miss The Point

Wal van Lierop

Apr 6, 2021

Previously published on Forbes.com

On March 16, an insider supposedly blew the lid on Wall Street greenwashing. Tariq Fancy formerly led Sustainable Investing at BlackRock, the world’s largest asset manager, whose CEO Larry Fink demanded in 2021 that all companies explain how they’ll reach net-zero emissions by 2050. “No issue ranks higher than climate change on our clients’ lists of priorities,” said Fink in his annual letter to CEOs.

Mr. Fancy says don’t buy it. “In truth, sustainable investing boils down to little more than marketing hype, PR spin and disingenuous promises from the investment community,” he wrote in USA Today.

The most surprising part of this ongoing controversy is that anyone is surprised. Wall Street greenwashes. That we knew. I’ve warned for years that ESG investing is mostly a charade, as have other cleantech investors. While I admire Mr. Fancy’s conviction, I fear that he is missing the point.

Even if the world’s biggest polluters wanted to go green – and even if the BlackRocks of the world supported them – they don’t have the technology to do it. ESG funds rarely invest in the step-change technologies that would enable polluters to eliminate fossil fuels from their value chain.

Unfortunately, Mr. Fancy doesn’t think much of those opportunities. “No matter what they tout as green investing,” he wrote, “portfolio managers are legally bound (as well as financially incentivized) to do nothing that compromises profits. To advance real change in the environment simply doesn’t yield the same return.”

True, it doesn’t yield the same returns – potentially, it yields significantly greater returns.

Industrial technology firms that exist today are likely to become multi-billion and even trillion-dollar companies in the next decade. Investors with the risk-tolerance and foresight to back step-change technologies will show Wall Street what ESG means – and show Mr. Fancy that saving the environment is immensely profitable.

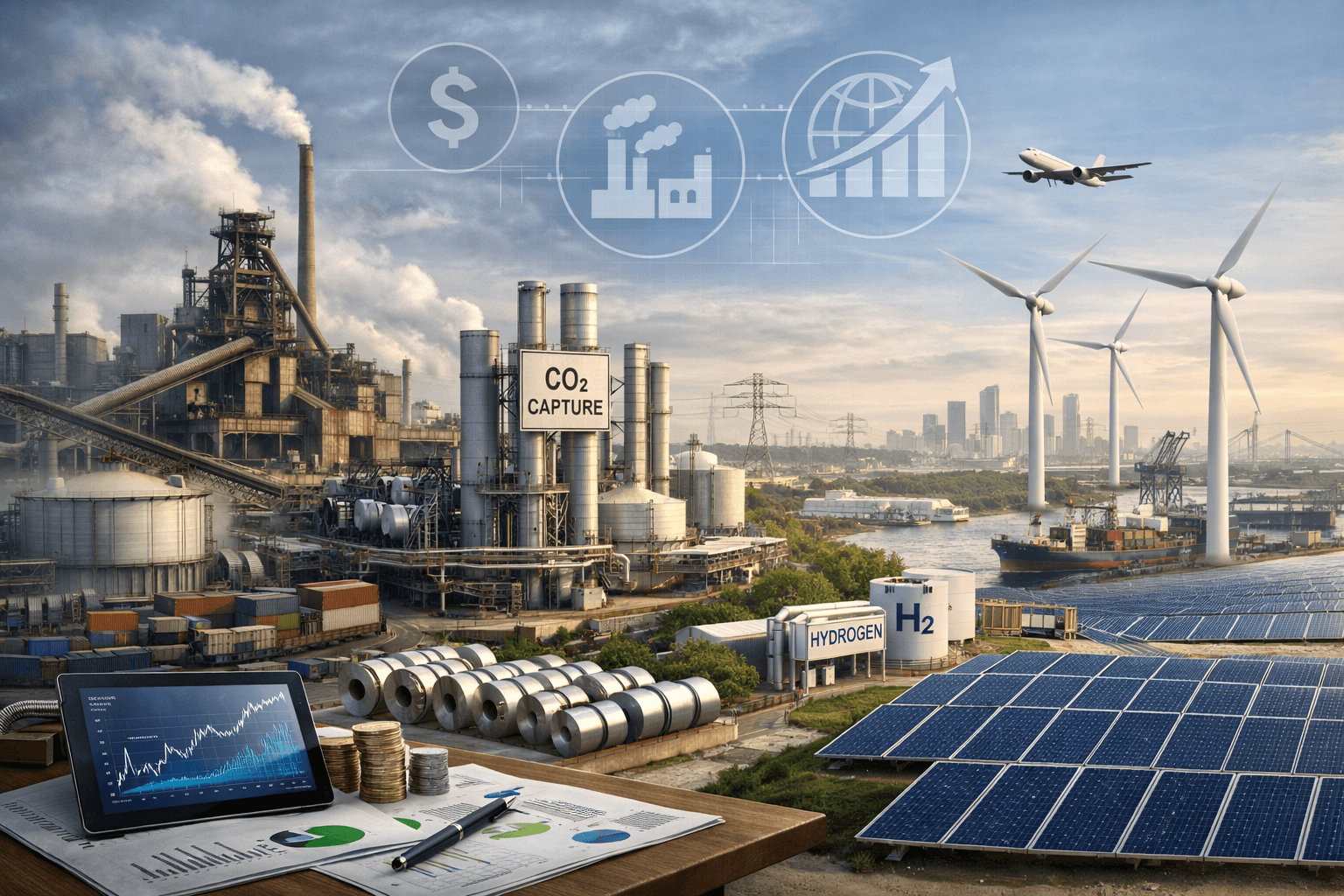

To be specific, I’m talking about innovations in electric power, cement, mining, metals, petrochemicals and shipping, which account for at least 40% of global emissions. Like it or not, we depend on those industries for a “first-world” lifestyle – and for the raw materials that make possible electrified transportation, solar power, and other pillars of a clean economy. Paris Agreement targets will not be achievable unless we decarbonize heavy industry.

Unfortunately, Wall Street investors want to be praised for making climate change slightly less horrific while continuing to maximize their returns. They do that by divesting from oil companies and investing even more in Big Tech, which can eliminate (or offset) emissions much more easily that a cement company.

Meanwhile, investors think, hope or pretend they can pressure steelmakers, utilities, etc. to abandon fossil fuels. Nice idea in theory. In practice, it looks like Climate Action 100+ (ca100+), an investor-engagement group representing over $50 trillion in assets, asking companies to set carbon targets, disclose climate risk and improve environmental governance.

How has that worked? The Economist found that 30% of ca100+ firms had adopted emissions targets in alignment with the Science-Based Targets Initiative (SBTI) versus 25% in a control group. “In both groups,” said The Economist, “the firms that set a green goal tend to be the small polluters.” Unlike major industrial firms, small polluters can decarbonize by transitioning to solar and wind energy.

Most ca100+ companies don’t pledge to reduce emissions because, once again, they don’t have the technology to do it. They don’t have the ability to heat metals and chemicals to industrial temperatures without coal and gas furnaces. We should at least give them credit for not lying about their capabilities.

That, by the way, is why the American Petroleum Institute (API), the top US oil lobby, advocates for carbon pricing. Technologically speaking, Exxon and Chevron can’t meet emissions caps that would make the U.S. carbon neutral by 2050, but they can continue with business as usual and pass the carbon fees on to customers. Apparently, the API doesn’t see enough investment in cleantech to feel threatened. That is alarming.

And I say we change that. Let the U.S. Securities and Exchange Commission debate ESG disclosures and decide who’s greenwashing or not. Let asset managers explain why their ESG portfolios have oil and mining companies. Meanwhile, let’s fund the technologies to build a clean, healthy economy that can provide good jobs and social stability for decades to come. The real ESG action (or inaction, as it were) isn’t happening at BlackRock. It’s happening at innovative, nimble startups.